Riding the waves of globalisation: 20 years of container transport from China to Europe

This year we are celebrating 20 years since our founding. It's a good time to take a look back at where shipping has moved in the last two decades.

BETTER ALREADY?

The largest volume of transported goods has long been reported by import services from Asia (mainly from China). Let's take a closer look at the development of container lines from China to Europe and subsequent shipments to the Czech Republic.

At the beginning of the noughties, shippers were still associated in shipping conferences, which jointly set the levels of rates and other surcharges (e.g. BAF, CAF). In 2008, the block exemption, which allowed maritime transport certain derogations from the normal competition rules, ceased to apply. Customers and freight forwarders expected more competition in the market and improved service levels from the abolition of these cartel agreements.

Have these expectations been met?

Competition in the market

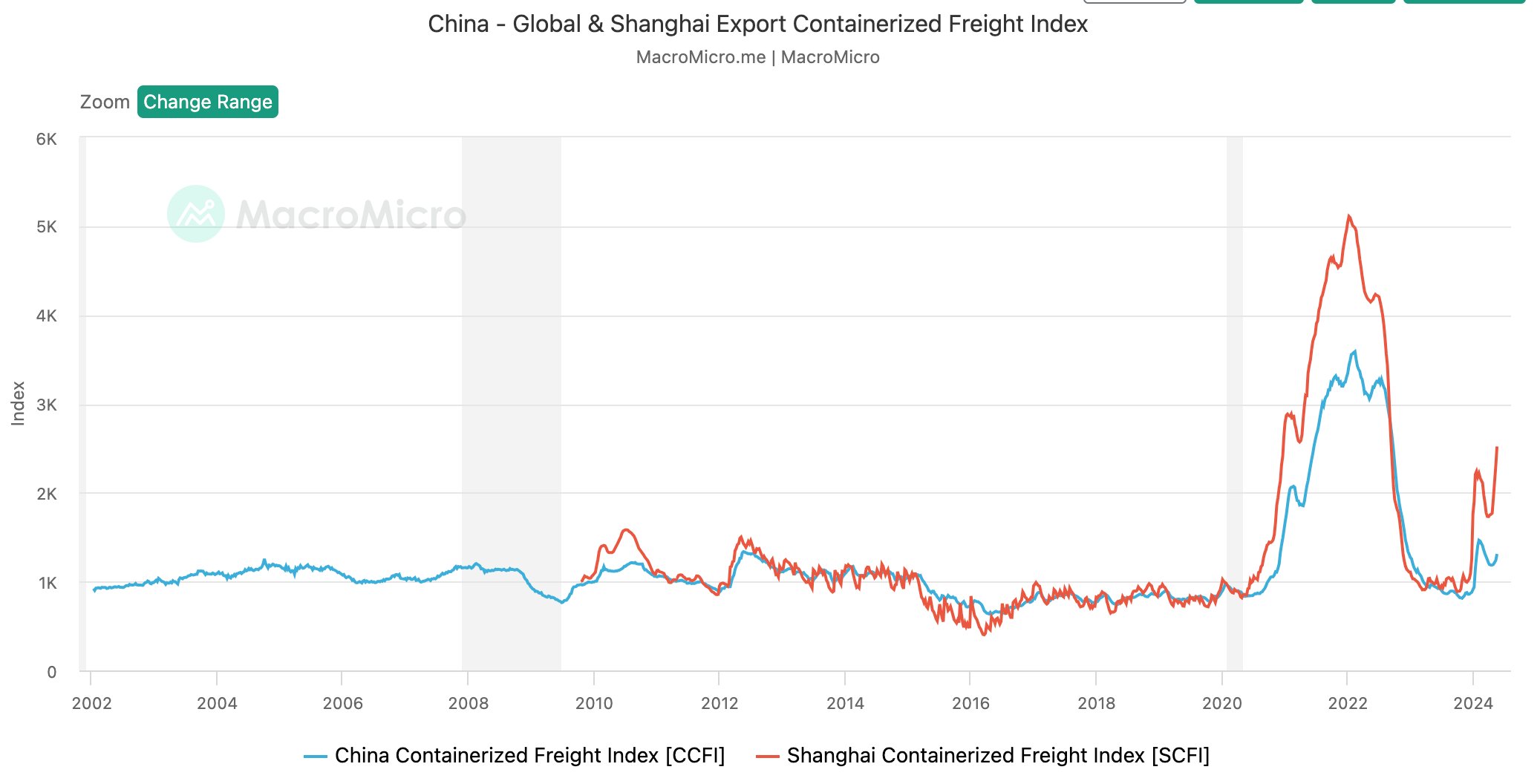

Prices

While the maritime conferences have disappeared, the relaxation of competition has not had much impact on price levels. Rates have been relatively stable, with some decline in the years of the 2008-2009 financial crisis and then roughly 10 years later in the years of global economic stagnation. The fall in prices caused major financial difficulties for most shipowners, some of whom did not sustain losses over the longer term (Hanjin). With the onset of the covid-19 contagion measures, prices instead headed to levels not seen before. The next price spike came in late 2023 after the rerouting of shipping lanes to a safe route around the Cape of Good Hope.

In 2005, more than 20 shipowners with significant market share served the services between China and Europe. Now it is less than half. Earlier conference pricing arrangements have been replaced by the pricing policies of the dominant shipowners.

Source: macromicro.org

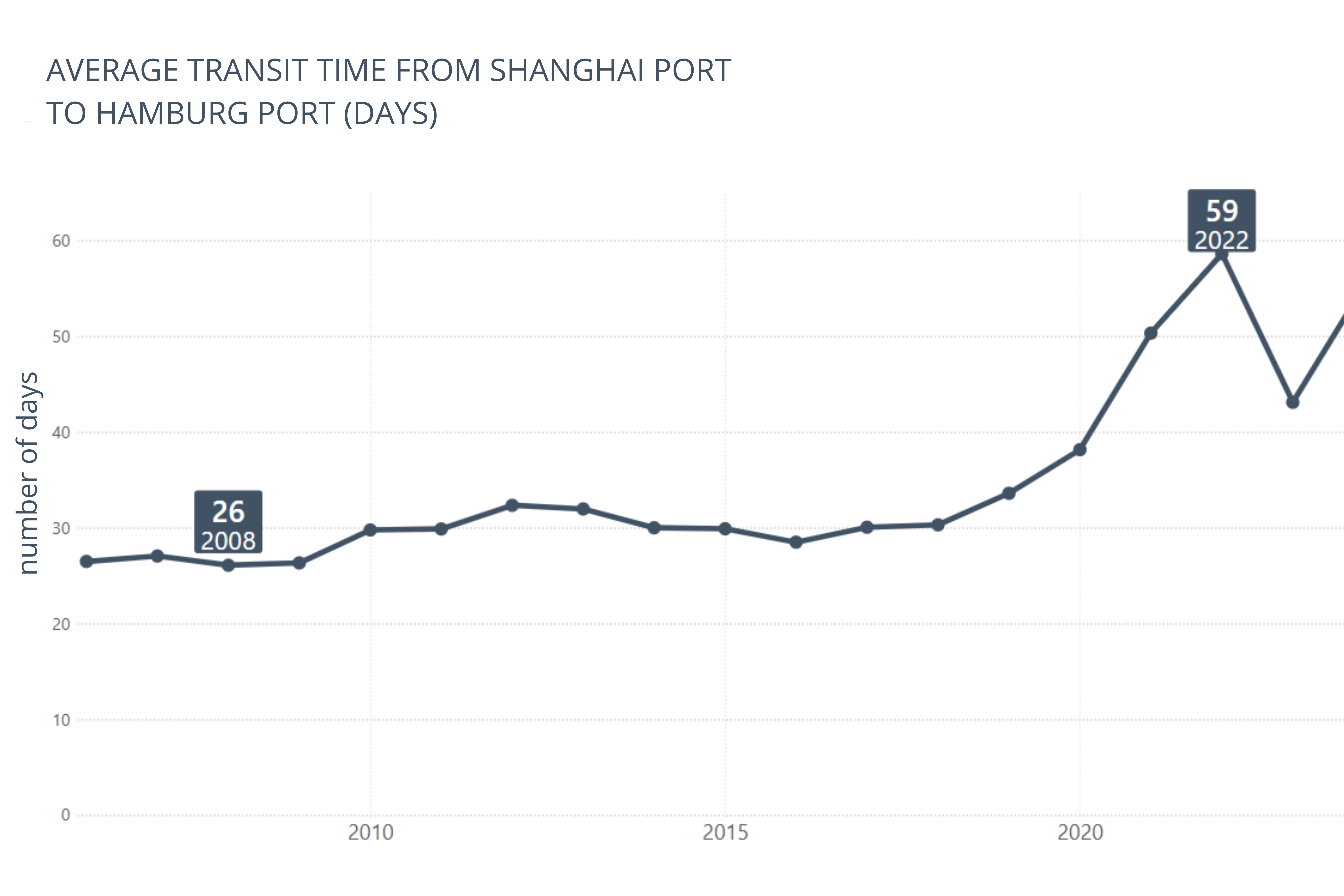

Speed and reliability of transport

Has there been an increase in transport times since 2005? As recently as around 2008, there was still a noticeable drive by shippers to come up with fast services, perhaps at the cost of a slightly higher price. It was possible to ship a container from Shanghai to Europe in less than 26 days. Now customers can wait twice as long for goods. First, slow-steaming slowed down shipping to reduce emissions, then, during the Covid-19 pandemic, there were problems with container clearance at ports (congestion) and the longer route around Africa put the nail in the coffin of speed.

AVERAGE TRANSIT TIME SHANGHAI - HAMBURG/BREMERHAVEN

Source: estone.cz

Service reliability used to be 90% or more. There was a more varied offer - longer less reliable transport times at a lower price, and on the other hand priority services with up to 98% reliability with a corresponding price tag. Today we choose from a range of services from 3 alliances with almost identical parameters and average reliability barely above 50%.

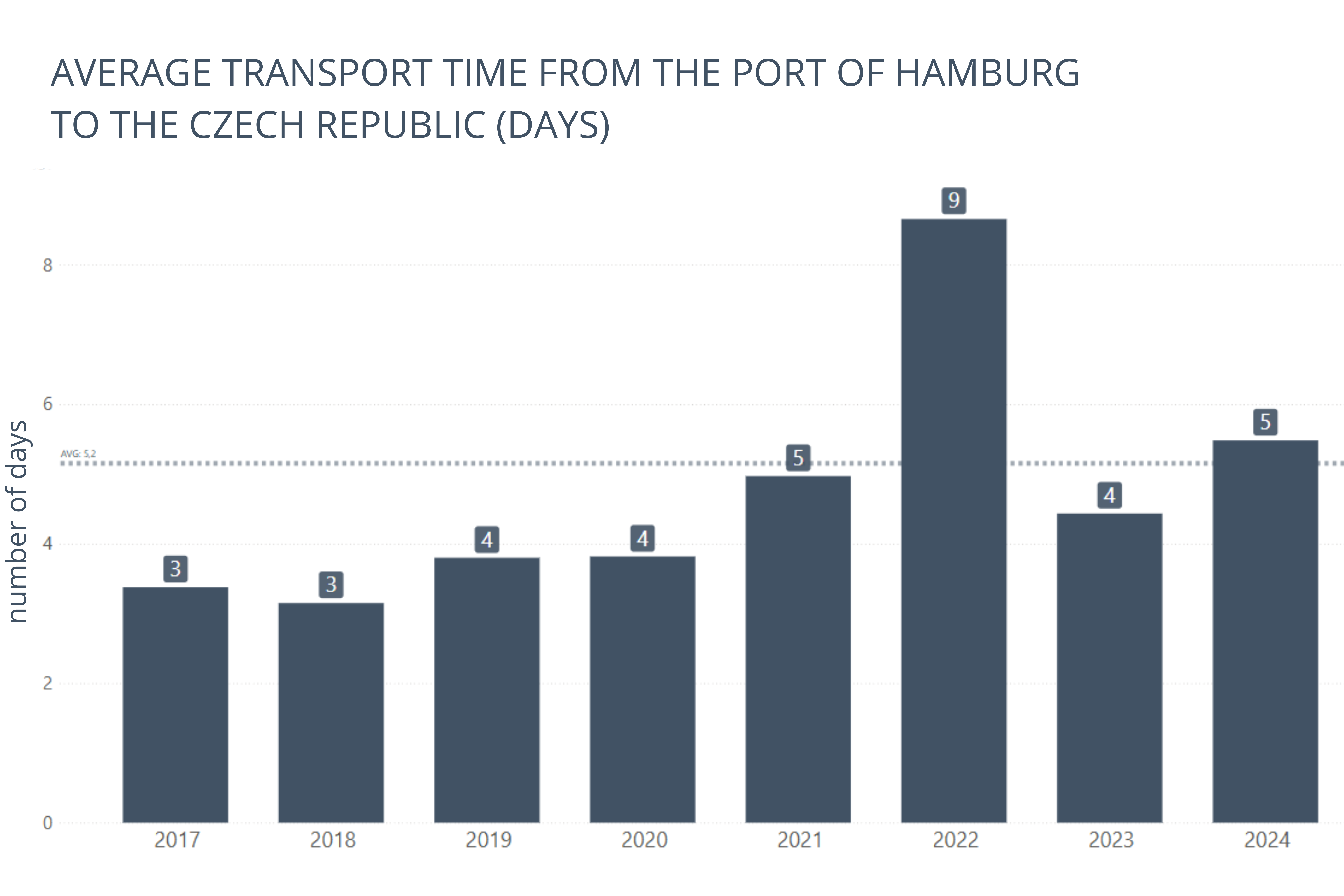

The ships were smaller, with a capacity of 6000-8000 TEU. A dramatic shift in ship size started in 2008 with Maersk with its E class, with a capacity of up to 11000 TEU. Today, ships with a capacity of 24000 TEU are being built. Smaller ships were able to be handled by ports within 1-2 days. Today, giant ships stay in port for 4-5 days. In the case of smaller ships, it was possible to schedule an urgent container removal from the port by truck to within hours. This is impossible today, because it is not known in advance whether the container will be taken off the ship on the first or the fifth day after arrival.

AVERAGE TRANSIT TIME FROM THE DAY OF ARRIVAL OF THE SHIP IN HAMBURG TO DELIVERY AT THE TRAIN OPERATOR'S DEPOT IN THE CZECH REPUBLIC

Source: estone.cz

Innovative solutions

In the noughties, breeders were trying to differentiate their services. Some offered the possibility of very fast transport from the main ports without transhipment en route, Maersk came up with its "Daily Maersk" service, where for a small extra charge it was possible to ensure that if the container was not unloaded on the scheduled ship, the container was loaded the next day on the next ship. As time went on, the efforts to come to the market with something new died down completely. There is some hope in the Hub and Spoke product of the Gemini alliance, which is now transforming its Far East services. Ships serving the main line to Europe are to call at a limited number of major ports (Hubs) and smaller secondary ports will be linked to these Hubs by feeder services.

This should help to improve the predictability and reliability of shipments.

Information age

Today we like to measure and compare everything. But it depends on how we deal with the overload of information and data. The past two decades have seen unprecedented improvements in real-time shipment information. Shippers are installing GPS locators in their containers, and there are countless tracking applications on the market using data from a variety of sources. But what good is all this when timetables are unreliable, waiting times for port clearance unpredictable and subsequent transport out of port uncertain due to various line closures, strikes or accidents? We know exactly where the container is, but we cannot quite specify, let alone influence, the exact day of delivery.

Security, bureaucracy

Over the years, the administrative burden of handling shipments has increased. Pre-declaration to customs systems, more frequent customs checks, CBAM reporting, expected administration of deforestation (EUDR).

Sustainability

A big theme of the last 20 years has been ecology. Measures include maritime transport, with ships having to meet IMO 2020 criteria, container terminals starting to use wind or photovoltaic electricity for their operation, and an increasing share of rail transport over road transport for shipments from ports inland. In contrast to these measures, it is impossible not to notice the enormous amount of transport that has not previously taken place and that has been created by the displacement of production or other manufacturing operations to cheaper remote regions.

Transport of dangerous goods

Significant progress has been made in this area. Strict measures in ports and at sea have helped to achieve better discipline in the shipping of dangerous goods consignments. Previously, misdeclared containers of pyrotechnics were the nightmare of shippers. Today's challenge is the transport of batteries and electric cars.

Planning the delivery of goods or components from the Far East has never been more difficult. We believe that the resulting white spaces in the market will be filled and, in turn, the diversity of supply will increase to better match demand.

BDP-Wakestone has arranging shipments from Asia in its DNA. From the available options, it is still possible to choose the most suitable mode of transport in terms of price and speed of delivery. But if the individual links in the chain are not working reliably, neither knowing the exact location of the shipment nor artificial intelligence can help. It takes personal supervision and inventiveness on the part of the freight forwarder to correct, at least in part, the current low reliability and predictability of the transport chain.